Breakout trading has gained significant popularity recently, offering traders a unique methodology to capitalize on market movements. In this article, we’ll delve into the intricacies of breakout trading strategy, outlining key strategies and pitfalls to avoid.

Table of Contents

Getting a Grip on Breakout Trading

So, breakout trading is all about capitalizing on opportunities when the price breaks through a specific level. This could be a swing high, resistance, or even a range.

The key thing is I’m getting into a trade when the market is moving the way I want it to, as opposed to a pullback where I’d be buying when the market is going against my intentions.

Watch Out for These Breakout Traps

Now, here’s a mistake I’ve made before impulsively chasing breakouts based on what looks like a bullish chart.

Also Read: Breakout and Retest Trading Strategy

You know, a string of green candles making me think the value is about to surge. But, this approach comes with two significant issues.

Firstly, when I chase breakouts, I place my stop-loss randomly, which doesn’t protect me effectively.

Secondly, this impulsive behaviour often happens before the market makes a pullback or a complete reversal, leading to unnecessary losses.

Executing Breakout Trades with Precision

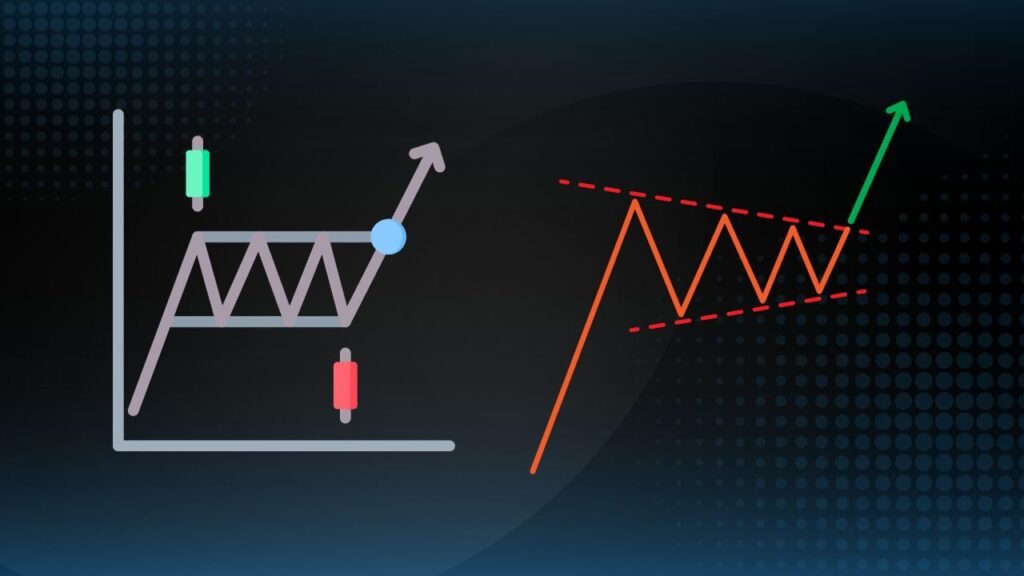

To succeed with breakout trading, I’ve found it crucial to be strategic. One approach that’s been working for me is looking for breakouts with a “buildup.”

This means watching the price get close to resistance but not breaking out immediately. Instead, it forms a tight consolidation pattern over a series of candles, showing strength in the market.

This consolidation phase indicates buyers are willing to engage at higher prices, even close to resistance. When I spot this buildup, I position myself strategically.

When the price eventually breaks out of resistance, I set a well-defined stop-loss just below the low of the build up. This way, I manage risk more effectively than setting a stop-loss within the broader range.

Making the Move with Breakout Trades

Executing a breakout trade with precision is a straightforward process. When the price surpasses resistance, I either use a buy stop order or wait for a confirmed break and close above resistance. Then, I set my stop-loss below the lows of the buildup, giving me a clear level of protection.

For added security, I sometimes put the stop-loss one Average True Range (ATR) below the buildup’s lows to further mitigate risk.

Also Read: How to Start Trading for Beginners

Navigating Winning Trades

Once a breakout happens, it’s important to have a clear exit strategy. In trending market conditions, I’ve found that trailing the stop-loss can be really effective.

Using a tool like the 50-period moving average, I can hold onto my position as long as the price stays above this key indicator. But if the price closes below it, that’s my cue to exit the trade.

Weighing the Pros and Cons of Breakout Trading

Like any trading strategy, breakout trading has its pros and cons. On the positive side, it gives me a high probability of catching trends as I enter trades on the brink of a breakout.

This approach isn’t just for range-bound markets; it can work in trending scenarios too. But, it’s important to remember there’s always a chance of false breakouts, a risk that comes with this strategy.

Also, I’ve had to shift my mindset from buying low and selling high to buying high and selling even higher.

Wrapping It Up

Breakout trading is a dynamic strategy that requires precision and strategic thinking. By avoiding impulsive behaviors and using a buildup-based approach, I’ve found I can increase my chances of success.

Remember, it’s all about capturing trends at their very start. With the right techniques, breakout trading can be a powerful tool in my trading arsenal. Wishing you the best of luck, and may your trades be prosperous!

Pingback: Breakout and Retest Trading Strategy - Senthil Stock Trader