Union bank of India is the first and largest bank in India. Do you know what was the price in 2002? Union Bank share price in 2002 was ₹9.45 per share. In this article, We will explore the Union Bank share price history from 2002 to 2024 and a few important details about the company.

Table of Contents

Union Bank Share Price History Table

| Year | Price | Yearly Change % |

|---|---|---|

| 2003 | 29.89 | 180 |

| 2004 | 68.13 | 128 |

| 2005 | 78.79 | 16 |

| 2006 | 81.98 | 4 |

| 2007 | 141.83 | 73 |

| 2008 | 115.79 | -18 |

| 2009 | 192.12 | 66 |

| 2010 | 256.95 | 34 |

| 2011 | 128.96 | -50 |

| 2012 | 216.78 | 68 |

| 2013 | 106.96 | -51 |

| 2014 | 201.94 | 89 |

| 2015 | 130.68 | -35 |

| 2016 | 109.92 | -16 |

| 2017 | 128.85 | 17 |

| 2018 | 76.70 | -40 |

| 2019 | 48.93 | -36 |

| 2020 | 28.17 | -42 |

| 2021 | 38.75 | 38 |

| 2022 | 75.78 | 96 |

| 2023 | 116.03 | 53 |

| 2024 | 121.54 | 5 |

Key Insights of Union Bank Share Prices

- Current Share Price (as of 02 September 2024): Union Bank‘s stock is priced at ₹121.38.

- 52-Week High: The stock reached its yearly peak at ₹168.06 on 03 June 2024.

- 52-Week Low: Union Bank‘s lowest price in the past year was ₹84.37, observed on 04 September 2023.

Union Bank Share Price 52-Week High & Low

The current price is ₹46.68 lower than the 52-week high.

The current price is ₹37.01 higher than the 52-week low.

Union Bank Share Price All Time High

Highest Ever Price: Union Bank shares hit an all-time high of ₹316.06 on 27 October 2010.

Highest Closing Price: The highest closing price recorded was ₹309.36 on 26 October 2010.

Union Bank Share Price All Time Low

Lowest Ever Price: Union Bank shares hit an all-time low of ₹8.09 on 17 October 2002.

Lowest Closing Price: The lowest closing price recorded was ₹8.18 on 16 October 2002.

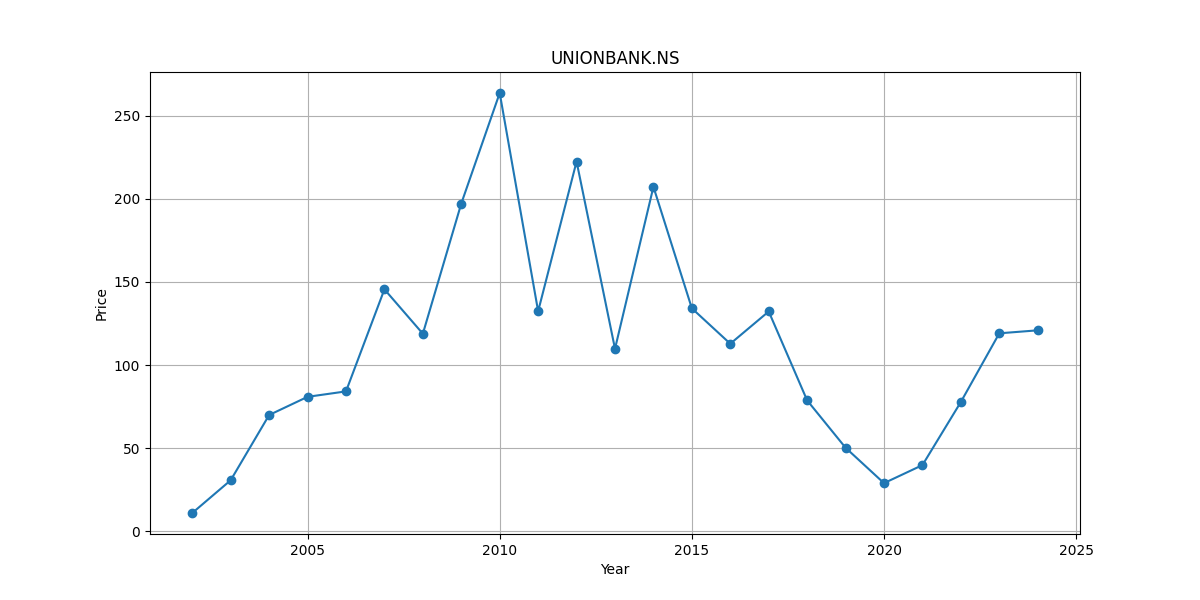

Union Bank Share Price History Chart from 2002 to 2024

Growth of Union Bank Shares from 2002 to 2024

- Highs and Lows in 23 Years: Union Bank‘s stock price saw a high of ₹316.06 and a low of ₹8.09 in the last 23 years.

- 2002 Share Price: Starting at ₹9.45 in 2002.

- 2024 Share Price: Climbed up to ₹121.38 by 2024.

- Impressive Returns: Investors saw a 1184.44% profit in 23 years with a steady growth rate of 11.74 per year.

- Investment Growth: If you invested ₹10,000 in Union Bank in 2002, by 2024, your money would have increased to ₹128444.44. That’s almost 12.84 times your original investment!

How Union Bank Share Performed in Last 5 years

Growth of Union Bank Shares from 2019 to 2024

Highs and Lows in 5 Years: Union Bank‘s stock price saw a high of ₹168.06 and a low of ₹20.22 in the last five years.

2019 Share Price: Starting at ₹77.42 in 2019.

2024 Share Price: Climbed up to ₹121.38 by 2024.

Impressive Returns: Investors saw a 56.99% profit in five years with a steady growth rate of 9.44% per year.

Investment Growth: If you invested ₹10,000 in Union Bank in 2019, by 2024, your money would have increased to ₹15698.79. That’s almost 1.57 times your original investment!

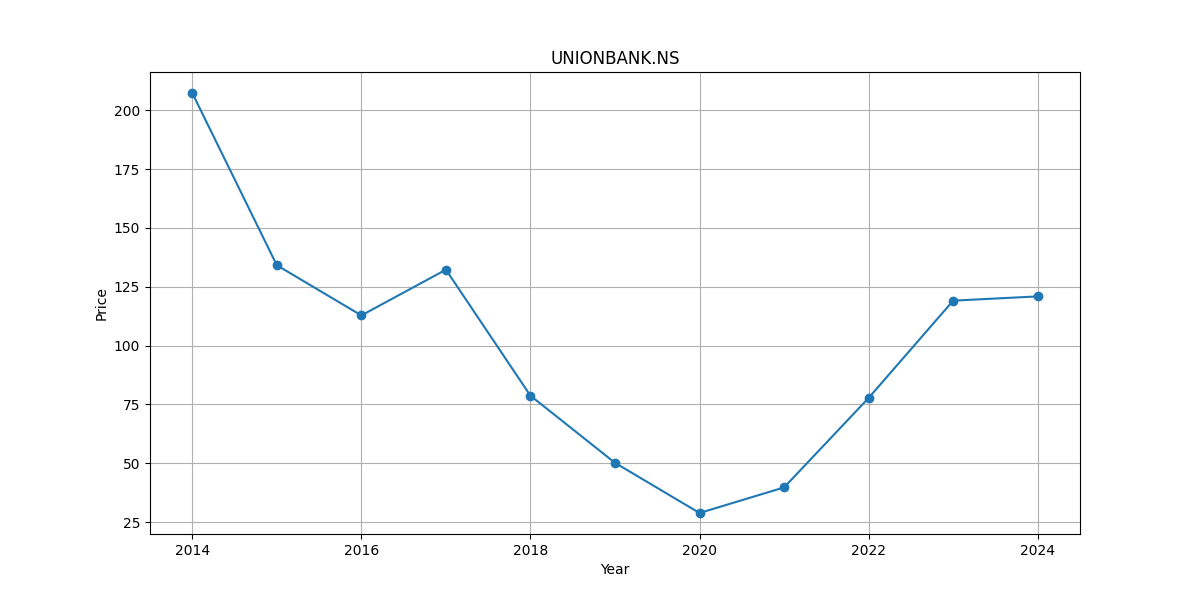

How Union Bank Share Performed in Last 10 years

Growth of Union Bank Shares from 2014 to 2024

Highs and Lows in 10 Years: Union Bank‘s stock price saw a high of ₹217.8 and a low of ₹20.22 in the last ten years.

2014 Share Price: Starting at ₹107.53 in 2014.

2024 Share Price: Climbed up to ₹121.38 by 2024.

Impressive Returns: Investors saw a 13.03% profit in ten years with a steady growth rate of 2.48% per year.

Investment Growth: If you invested ₹10,000 in Union Bank in 2014, by 2024, your money would have increased to ₹11302.89. That’s almost 1.13 times your original investment!

How Union Bank Share Performed in Last 15 years

Growth of Union Bank Shares from 2009 to 2024

Highs and Lows in 15 Years: Union Bank‘s stock price saw a high of ₹316.06 and a low of ₹20.22 in the last fifteen years.

2009 Share Price: Starting at ₹115.51 in 2009.

2024 Share Price: Climbed up to ₹121.38 by 2024.

Impressive Returns: Investors saw a 7.83% profit in fifteen years with a steady growth rate of 1.53% per year.

Investment Growth: If you invested ₹15,000 in Union Bank in 2009, by 2024, your money would have increased to ₹10522.03. That’s almost 1.05 times your original investment!

About Union Bank of India

Union Bank of India is one of the central public sector banks in the country. It has a 100% core banking solution. Its headquarter is located in Mumbai, India.

The government of India holds 74.76% of the Union Bank’s capital. The Bank was listed as a limited company on November 11, 1919. It has also extended its subsidiary across all states and territories.

On April 01, 2020, Corporation Bank and Andhra Bank were incorporated into the Union Bank of India.

It has several networks across India:

- 19,500+ Business correspondents

- 74,500+ Employees

- 9,300+ ATMs

- 8400+Domestic branches

As of June 30th 2024 report, the union bank holds deposits ₹12,24,191 Cr and advances ₹9,12,214 Cr. So its total business worth is ₹21,36,405 Cr.

The Union bank has two foreign branches:

- Sydney (Australia)

- Dubai International financial centre in UAE

This bank receives several awards and recognition for different categories:

- Development of human resources

- MSME

- Financial inclusion

- Digital banking

- Prowess in technology

Union Bank Similar Stocks

| State Bank of India | ₹729140.79 |

| Bank of Baroda | ₹129232.34 |

| Punjab National Bank | ₹128223.28 |

| IOB | ₹114624.22 |

| Canara Bank | ₹100684.21 |

| Indian Bank | ₹75867.74 |

FAQs

Is it worth investing in Union Bank shares?

According to the Trailing Twelve Months report, TTM P/E ratio is 7.11. Experts are analysing the Union Bank shares. They are sharing their opinion through ratings. There are 10 experts involved in Union bank ratings. Let’s know its ratings:

4 experts have provided strong buy rating of Union bank

3 have given buy rating of Union bank stock

1 expert have provided sell rating

What do you think about the Union Bank share price in the next 3 to 5 years?

Compared to the previous year, total business of Union bank has increased by 9.76% YoY. Its total deposits grew by 8.52% YoY. Further, its gross advances increased by 11.46% YoY.

Union Bank has also provided good profit growth of 46.4% CAGR over the last 5 years so that the Union Bank share price will have a chance to increase in the next 3 to 5 years.

What is the total Business worth of Union Bank?

Bank has a total business worth ₹21,36,405 Crores as on June 30, 2024.

What has been the Union bank’s dividend payout percentage?

The Union Bank has been maintaining a healthy dividend payout of 22.9%

Who is the Managing Director and CEO of Union Bank?

Ms. A Manimekhalai is the Managing Director and CEO of Union Bank. As on September 2024

How much share does the Union Bank have outstanding?

Union Bank company has a total of ₹763.36 Cr shares outstanding. As on September 2024

What was the Union Bank share price in 2021?

The Union Bank share price in 2021 was ₹38.75

What was the Union Bank share price in 2005?

The Union Bank share price in 2005 was ₹78.79.

What was the Union Bank share price in 2010?

The Union Bank share price in 2010 was ₹256.95.

What was the Union Bank share price in 2000?

The Union Bank was not listed on the National exchange in 2000 so there is no data available for the year 2000. As stated in 2002 Union bank share price history, its price was ₹9.45.

What was the Union bank share price history 2020?

The Union Bank share price in 2020 was ₹28.17.

What is the dividend of Union Bank in 2024?

The Union Bank has been sustaining a strong dividend payout of 22.9%

Sources: Yahoo Finance, Screener

Disclaimer

The information is presented ‘as is’ and is intended solely for educational and informational purposes, not for trading decisions or professional advice. We strongly advise conducting your own thorough research before making any investment.